How President Trump’s ‘One Big Beautiful Bill’ Will Impact Businesses in Australia

14 Juni 2025

14 Juni 2025

Retaliatory tax provisions contained in H.R. 1, the “One Big Beautiful Bill Act” that recently passed the US House of Representatives, if enacted, would drastically impact common cross-border transactions, including US operations of foreign multi-national groups and inbound investments.

APPLICABILITY OF SECTION 899

Code Section 899 imposes retaliatory taxes on “applicable persons” resident in “discriminatory foreign countries,” which are defined as countries that impose unfair foreign taxes (UFTs). The US Treasury Department would quarterly publish a list of discriminatory foreign countries. The “applicable persons” subject to increased taxes include individuals and corporations resident in discriminatory foreign countries, as well as foreign corporations more than 50% (by vote or value) owned directly or indirectly by such applicable persons (unless such majority-owned corporations are publicly held). Subsidiaries of US-parented multinational groups would generally not be applicable persons.

Three categories of taxes are identified as “per se” UFTs: undertaxed profits rule taxes imposed pursuant to the OECD’s Pillar 2, digital service taxes, and diverted profits taxes.

Australia has adopted both the Undertaxed Profits Rule as well as the Diverted Profits Tax, and so Australia is a discriminatory foreign country and subject to the retaliatory tax provisions in section 899.

Certain categories of taxes, including value-added taxes, goods & services taxes, and sales taxes, are exempted from being classified as UFTs. Australia’s Digital Services Tax is contained in the Goods and Services Tax and so is not currently classified as having a Digital Services Tax.

When a country repeals all of its UFTs, it generally will cease to be a discriminatory foreign country, and persons associated with that country generally will cease to be applicable persons.

RETALIATORY TAX PROVISIONS

The retaliatory tax provisions in Code Section 899 mainly fall into two categories, (1) increased rates of US tax on applicable persons, and (2) a more stringent version of the base erosion and anti-abuse tax (“BEAT”) currently contained in Code Section 59A, referred to as the “Super BEAT.”

Increased Rates of US Tax on Applicable Persons

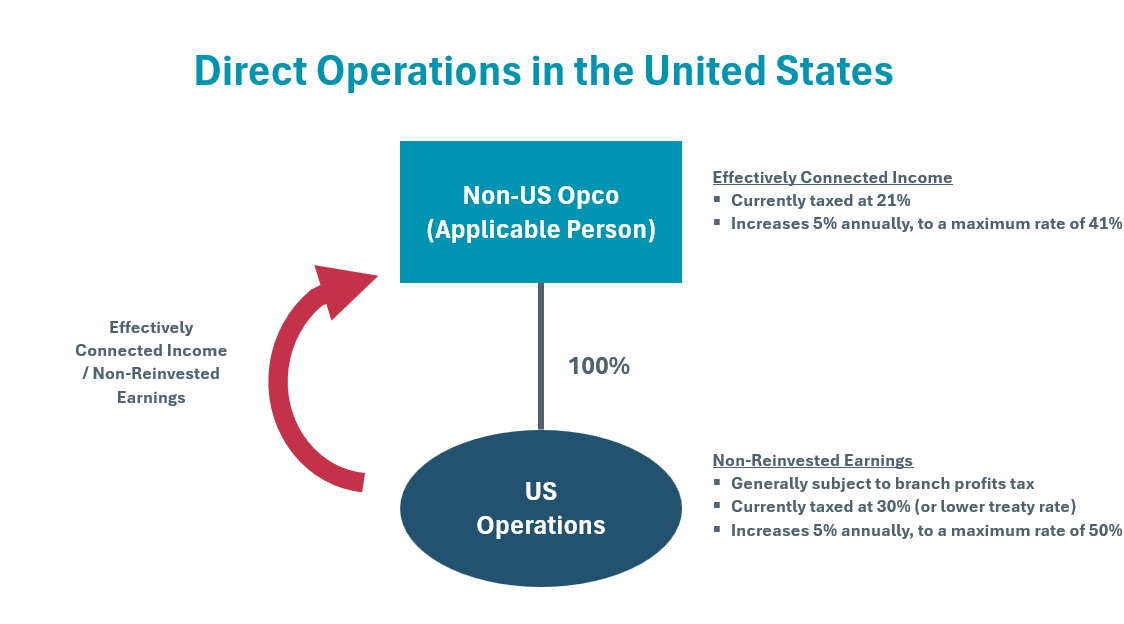

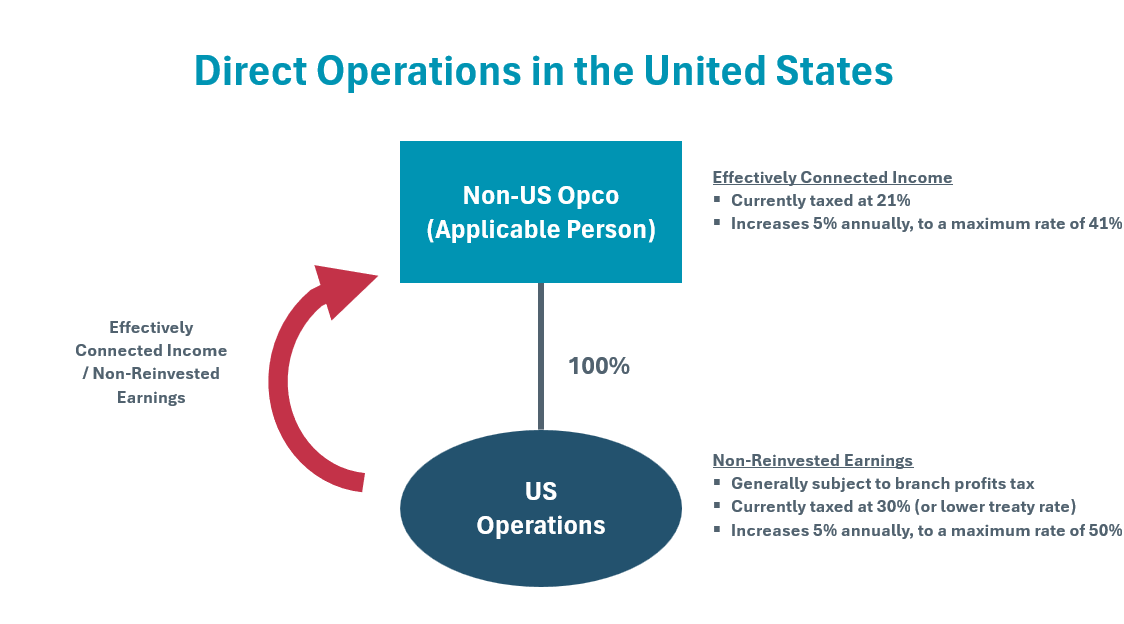

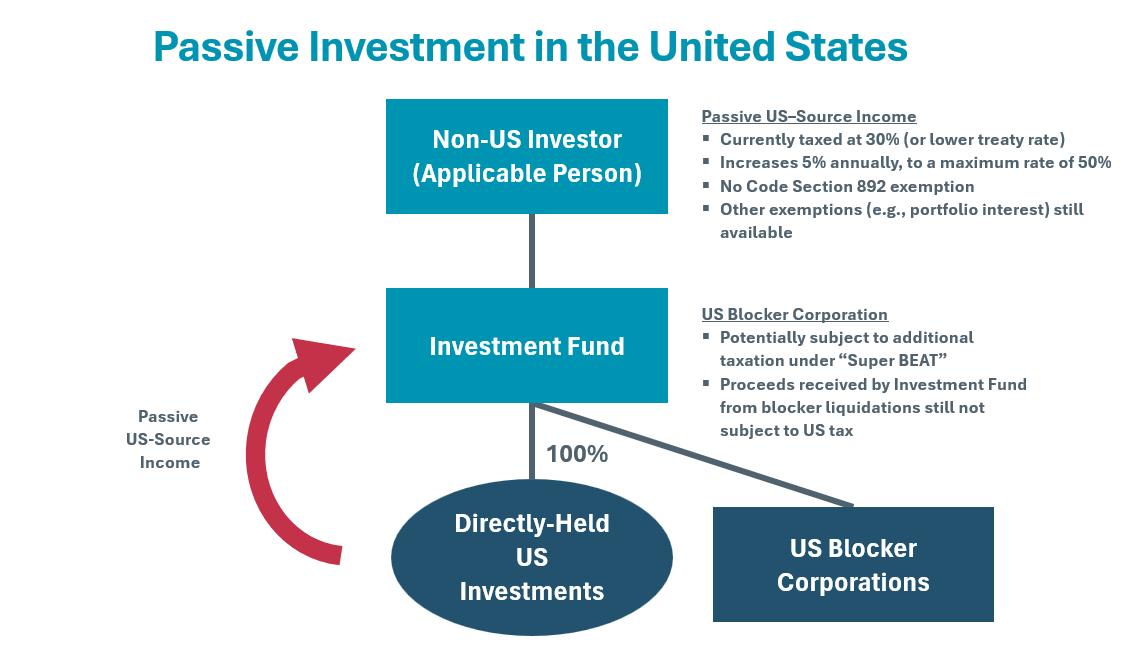

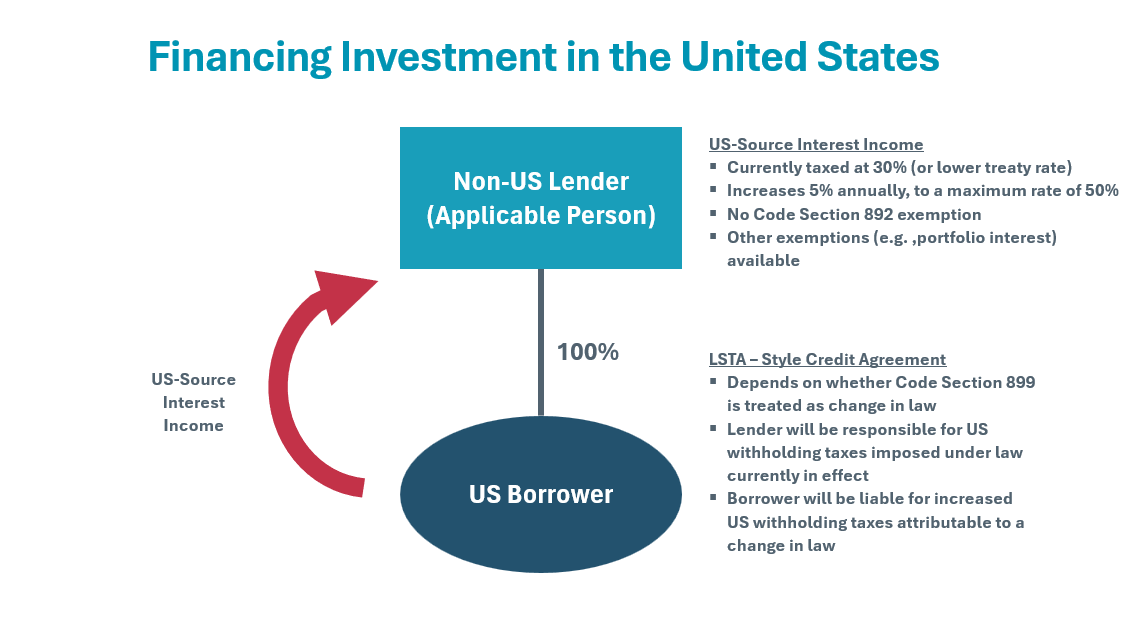

The rates of US tax to which applicable persons are subject would be increased 5 percentage points each year, possibly beginning in the current year, until the rates reach a maximum of 20 percentage points above the current statutory rates (determined without regard to any treaty). The applicable US tax rates that would be subject to increase include (1) the 30% withholding tax on passive US-source income (e.g., dividends, interest, rent, and royalties), (2) the 21% corporate income tax, and (3) the 30% branch profits tax imposed on the non-reinvested earnings of a US trade or business conducted by a foreign corporation.

Income that is currently statutorily exempt from US tax–such as US-source interest income that qualifies for the “portfolio interest” exemption–would, generally speaking, remain exempt from US tax; however, Code Section 899 expressly overrides the US tax exemption for sovereign wealth funds and other foreign governmental entities contained in Code Section 892.

In the case of appliable persons that qualify for a zero or reduced rate of tax pursuant to an income tax treaty, the increased tax rate to which the applicable person is subject would initially be 5 percentage points above the applicable treaty rate, although the rate would climb 5 percentage points each year until it reached 20 percentage points above the maximum statutory rate (determined without regard to a treaty). This may result in a 50% withholding rate on certain distributions from the United States.

The Super BEAT

In addition to the current BEAT in Code Section 59A, which was adopted as part of the 2017 Tax Cuts and Jobs Act, Code Section 899 would impose a modified “Super BEAT” on US corporations which are more than 50% owned (by vote or value, directly or indirectly) by applicable persons.

Several aspects of the Super BEAT would make it more likely for targeted companies to be liable for the BEAT. First, certain thresholds that limit the applicability of the regular BEAT would be removed. The current BEAT only applies to US subsidiaries (1) of multinational groups with gross receipts of at least $500 million, and (2) whose “base erosion” payments – i.e., deductible payments to related foreign persons–exceed 3% of total deductions (or 2% in the case of certain financial firms). These thresholds would not apply under the Super BEAT, potentially subjecting US companies to the Super BEAT despite not being part of large multi-national groups or making significant related-party payments.

The new Super BEAT would potentially both increase the tax liability of current BEAT taxpayers and subject additional US companies to the BEAT.

APPLICATION TO COMMON CROSS-BORDER TRANSACTIONS

CONCLUSION

The retaliatory tax provisions in Code Section 899, if enacted, would have a significant and potentially negative impact on a wide variety of cross-border transactions, including US operations of foreign multi-national groups. Click here for a more comprehensive alert on this issue.